As the festive season approaches, Bank of India (BOI) is spreading joy with its exclusive Diwali Loan Offer for 2024. If you’re planning to buy gifts, renovate your home, or cover festive expenses, this offer is perfect for you. With low-interest rates, quick approvals, and flexible repayment options, now is the time to make your Diwali brighter. Read on to find out more about the BOI Diwali Loan Offer, its features, and how you can apply quickly.

Why Choose Bank of India for Your Diwali Loan?

Bank of India is one of India’s leading public sector banks, known for its customer-centric financial products. With its new Diwali Loan Offer, BOI is making it easier for individuals to manage their festive season finances without worrying about high-interest loans or tedious approval processes.

Here’s why you should consider BOI’s special Diwali loan offer:

- Low-interest rates starting at just 8.90% per annum.

- Minimal documentation requirements, making the application process hassle-free.

- Quick disbursal within 24 to 48 hours of approval.

- Flexible repayment tenure ranging from 12 to 60 months.

- Special processing fee waivers and discounts during Diwali.

- No hidden charges, ensuring transparency in the loan process.

Key Features of the BOI Diwali Loan

- Low-Interest Rates Bank of India offers one of the most competitive interest rates in the market. During this Diwali season, the interest rate starts at just 8.90% per annum, ensuring that your EMIs remain affordable. The exact rate may vary depending on your credit score and loan amount, but the festive discount makes it an attractive offer.

- High Loan Amount Depending on your eligibility, you can apply for a loan ranging from ₹50,000 to ₹10 lakhs. Whether you need funds for home renovation, buying electronics, or festive shopping, this offer has got you covered.

- Flexible Tenure Bank of India offers flexible repayment options with loan tenures ranging from 12 months to 60 months. You can choose a tenure that fits your budget and repayment capacity.

- Quick and Simple Process One of the biggest advantages of the BOI Diwali loan is the fast approval and disbursal process. With minimal documentation, the loan amount can be credited to your account within 24 to 48 hours after approval, ensuring that your festive plans go uninterrupted.

- Minimal Processing Fees During the festive season, Bank of India is offering a significant reduction in processing fees, making this loan even more affordable. This discount can help you save a significant amount when availing the loan.

Also Read :- How Can We Get Loan Upto 1 Lakh With Low Cibil Score 0% Interest 30 Days

Eligibility Criteria for Bank of India Diwali Loan

To apply for the Bank of India Diwali Loan, you must meet the following eligibility requirements:

- Age: The applicant must be between 21 and 60 years of age.

- Employment: Both salaried individuals and self-employed professionals are eligible.

- Minimum Income: For salaried individuals, the minimum income should be ₹15,000 per month. For self-employed individuals, the business turnover should meet BOI’s criteria.

- Credit Score: A good credit score (typically above 700) is necessary to avail of the lowest interest rates.

Documents Required to Apply for BOI Diwali Loan

Bank of India has simplified the documentation process for this festive offer. Here’s what you’ll need:

- Proof of identity (Aadhar card, PAN card, passport, or voter ID).

- Proof of address (Aadhar card, utility bills, rental agreement).

- Income proof (salary slips, bank statements for the last 3 months, or income tax returns for self-employed individuals).

- Bank account details for loan disbursal.

How to Apply for Bank of India Diwali Loan?

Applying for the BOI Diwali Loan is easy, and you can do it both online and offline:

- Online Application:

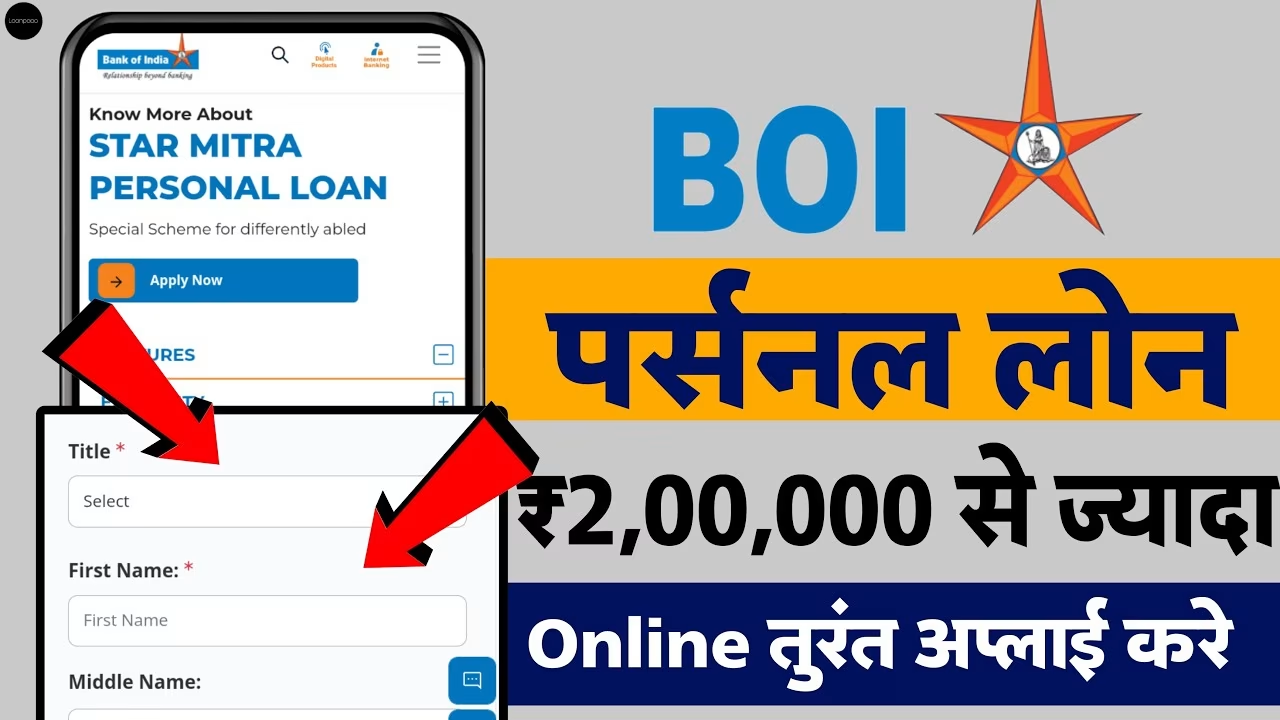

- Visit the official Bank of India website or download the BOI mobile app.

- Navigate to the ‘Loans’ section and select ‘Personal Loans’.

- Choose the Diwali Loan Offer, and fill in your details.

- Upload the required documents and submit your application.

- Once your application is processed and approved, you’ll receive the loan amount within 24 to 48 hours.

- Offline Application:

- Visit the nearest Bank of India branch.

- Speak to a bank representative about the Diwali Loan Offer.

- Submit your application form along with the necessary documents.

- Once approved, the loan amount will be credited to your account.

Why You Should Apply Fast?

Bank of India’s Diwali Loan Offer is time-limited and available only during the festive season. With attractive interest rates, minimal processing fees, and quick approvals, this offer is designed to make your Diwali celebrations hassle-free. However, the offer is subject to availability, and processing times may increase as more people apply. To ensure you don’t miss out, it’s best to apply as soon as possible.

Conclusion

If you’re looking for a personal loan this Diwali, Bank of India’s festive loan offer is one of the best options available. With low-interest rates, flexible tenures, and quick disbursals, BOI makes it easy for you to manage your festive expenses without any financial stress. Apply today and bring home the joy of Diwali with Bank of India!

2 thoughts on “Bank Of India New Diwali Loan Offer, Apply Fast With Low Interest Rate”